This guide, including the FAQs below, was designed to help you understand the Wisconsin health insurance options available for you and your family. The plans found in Wisconsin’s ACA Marketplace may be a good choice for many consumers, and we’re here to help explain the Marketplace and the financial assistance that’s available to most enrollees.

Wisconsin uses the federally run health enrollment platform, known as HealthCare.gov , for residents to purchase its ACA Marketplace plans. The Marketplace provides access to health insurance products from a total of 14 private insurers, although plan availability varies from one area of the state to another. 1 All 14 insurers plan to continue to offer Marketplace coverage in 2025. 2

Depending on your income and other circumstances, you may qualify for a premium tax credit to lower your monthly insurance premium (the amount you pay to enroll in the coverage) and possibly also a subsidy that will reduce your out-of-pocket expenses .

Wisconsin created a reinsurance program starting in 2019 (the Wisconsin Healthcare Stability Plan), which has helped to keep pre-subsidy health insurance premiums lower than they would otherwise be. 1

Hoping to improve your smile? Dental insurance may be a smart addition to your health coverage. Our guide explores dental coverage options in Wisconsin.

Learn about Wisconsin's Medicaid expansion, the state’s Medicaid enrollment and Medicaid eligibility.

Use our guide to learn about Medicare, Medicare Advantage, and Medigap coverage available in Wisconsin as well as the state’s Medicare supplement (Medigap) regulations.

Short-term health plans provide temporary health insurance for consumers who may find themselves without comprehensive coverage. Learn more about short-term plan availability in Wisconsin.

To qualify for health coverage through the Wisconsin Marketplace, you must 3 :

Eligibility for financial assistance (premium subsidies and cost-sharing reductions) depends on your income. In addition, to qualify for financial assistance with your Marketplace plan you must:

In Wisconsin, you can sign up for an ACA-compliant individual or family health plan from November 1 to January 15 during open enrollment. 6

If you need your coverage to take effect on January 1, you must apply by December 15. If you apply between December 16 and January 15, your coverage will begin on February 1. 7

Outside of open enrollment, you’ll need a special enrollment period to sign up for coverage or switch to a different plan. In most cases, special enrollment periods are linked to specific qualifying life events .

If you have questions about open enrollment, you can learn more in our comprehensive guide to open enrollment . We also have a comprehensive guide to special enrollment periods .

To enroll in an ACA Marketplace plan in Wisconsin, you can:

You may find affordable health insurance options in Wisconsin by signing up through HealthCare.gov – especially if you’re eligible for subsidies, which most people are.

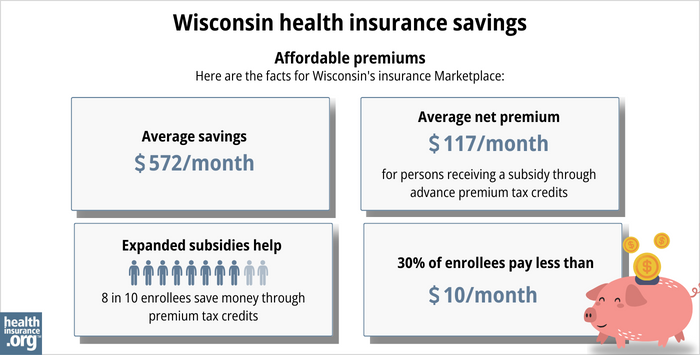

As of early 2024, almost nine out of ten Wisconsin health insurance Marketplace enrollees were receiving premium subsidies that amounted to an average savings of $573/month. As a result, the average enrollee’s net premium — including those who paid full price — was about $161. 9

(Note that the chart below includes some different metrics and is based on total enrollment during the open enrollment period for 2024 coverage, whereas the numbers above are based on effectuated enrollment in early 2024.)

Here are the facts for Wisconsin’s insurance Marketplace: Average savings - $572/month. Average net premium - $117/month for a person receiving a subsidy through advance premium tax credits. Expanded subsidy help - 8 in 10 enrollees save money though premium tax credits. 30% of enrollees pay less than $10/month." width="700" height="355" />

Here are the facts for Wisconsin’s insurance Marketplace: Average savings - $572/month. Average net premium - $117/month for a person receiving a subsidy through advance premium tax credits. Expanded subsidy help - 8 in 10 enrollees save money though premium tax credits. 30% of enrollees pay less than $10/month." width="700" height="355" />

The Affordable Care Act also ensures that people with household incomes up to 250% of the poverty level can enroll in Silver-level plans with reduced out-of-pocket costs, thanks to cost-sharing reduction (CSR) subsidies. 11

Between the premium subsidies and cost-sharing reductions, you may find that an ACA Marketplace plan offers the best value in terms of fitting your coverage needs and budget.

Wisconsin has not expanded Medicaid under the ACA, but also does not have a coverage gap. This is because Wisconsin allows adults with income under the poverty level to enroll in Medicaid, and Marketplace subsidies pick up where that ends, allowing those with income of at least the poverty level to enroll in subsidized Marketplace coverage. As a result, Wisconsin is the only non-expansion state that doesn’t have a coverage gap. 12

There are 14 insurers offering individual and family plans in Wisconsin’s exchange in 2024, 1 including one newcomer — UnitedHealthcare. 13

For 2025, all 14 insurers have filed rates and plans for Marketplace coverage. 2

One of Wisconsin’s Marketplace insurers (Common Ground Healthcare Cooperative) is an ACA-created CO-OP, and is one of only three CO-OPs still operational in the U.S. 14

In every Wisconsin county, Marketplace enrollees can select from among at least three insurers’ plans for 2024. 1

The following average rate changes have been proposed by Wisconsin’s exchange insurers for coverage in 2025, and are under review by state regulators 2 (calculated before subsidies are applied):

Additional filing data are available in SERFF , although Wisconsin’s rate review webpage still showed 2024 plans as of mid-August 2024 .

Rates for 2025 plans will be finalized before open enrollment begins in November 2024. The proposed premium changes described above are averages across each insurer’s entire set of policies (within a given insurer’s plans, there is variation in terms of how much each plan’s rate changes), and are calculated before any subsidies are applied. But most Wisconsin Marketplace enrollees receive premium subsidies, 9 and thus do not pay full-price for their coverage.

For perspective, here’s an overview of how full-price (unsubsidized) premiums have changed in Wisconsin’s individual/family health insurance market over time:

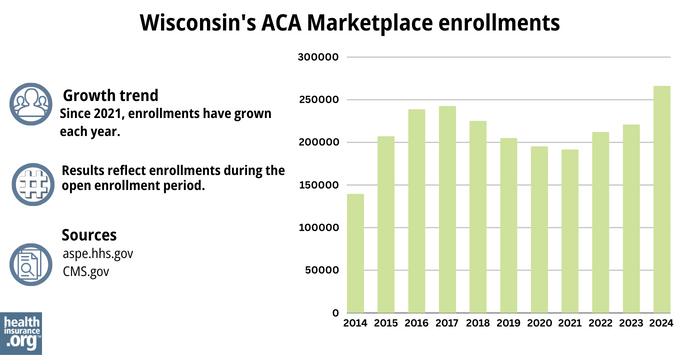

During the open enrollment period for 2024 coverage, 266,327 people enrolled in private individual market plans through Wisconsin’s exchange. 25

This was a record high for Wisconsin Marketplace enrollment (see chart below). Enrollment growth in recent years was largely due to the American Rescue Plan (ARP). Under the ARP – now extended by the Inflation Reduction Act – subsidies are more significant and accessible through the end of 2025. 25

The enrollment growth in 2024 was also due to the “unwinding” of the pandemic-era Medicaid continuous coverage rule. CMS reported that by April 2024, nearly 72,000 people had transitioned from Wisconsin Medicaid to a Marketplace plan.[ efn_note]” HealthCare.gov Marketplace Medicaid Unwinding Report ” Centers for Medicare & Medicaid Services. Data through April 2024; Accessed Aug. 3, 2024[/efn_note]

Source: 2014, 26 2015, 27 2016, 28 2017, 29 2018, 30 2019, 31 2020, 32 2021, 33 2022, 34 2023, 35 2024 36

Wisconsin Office of the Commissioner of Insurance

Assists consumers who have purchased insurance on the individual market or who have insurance through an employer who only does business in Wisconsin.

(800) 236-8517 / [email protected]

State Exchange Profile: Wisconsin

The Henry J. Kaiser Family Foundation overview of Wisconsin’s progress toward creating a state health insurance exchange.

Wisconsin Individual Health Insurance Market Analysis

An analysis of Wisconsin’s individual/family health insurance market from 2014 through 2022.

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org.